Supplemental Benefits

Liberty is pleased to offer employees the opportunity to purchase supplemental products that could provide cash payments for an eligible hospital admission or diagnosis. The Hospital Indemnity and Cancer Advocate Plus plans are offered through Chubb and the Accident and Critical Illness plans are offered through Lincoln Financial. All of these products will pay cash payments for covered hospitalizations, accidents, or illnesses directly to the covered member. Coverage is available for employees and their eligible dependents.

Hospital Indemnity

- Provides cash benefits directly to you for hospitalization regardless of other coverage you have

- Coverage is available for you, your spouse and/or children

- Policy is fully portable if you leave or retire

- No pre-existing condition limitation (except for pregnancy and childbirth expenses when conception occurred prior to the coverage effective date)

- $50 Wellness Benefit

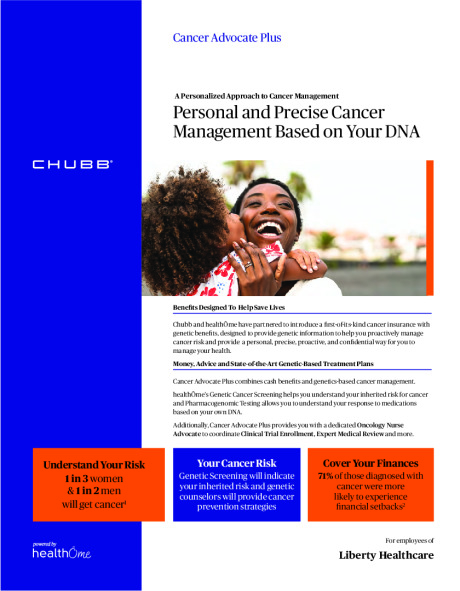

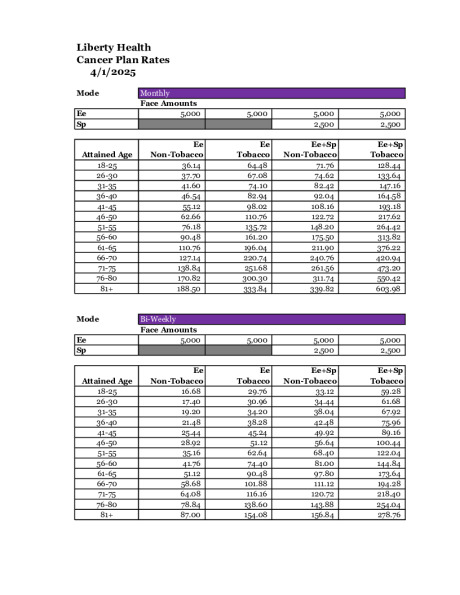

Cancer Advocate Plus

- Offers unique cancer prevention, treatment management, and recovery support in addition to cash benefits

- healthOme’s Genetic Cancer Screening helps determine inherited risk for cancer and Pharmacogenomic Testing allows you to understand your response to medications based on your own DNA

- Includes a dedicated oncology nurse advocate to coordinate clinical trial enrollment, expert medical review, and more

- Pays cash benefits directly to you regardless of other coverage you have

- Pays $5,000 upon cancer diagnosis and an additional $2,500 cash payment after 6 months and then again after 12 months, totaling $10,000 total cash payout

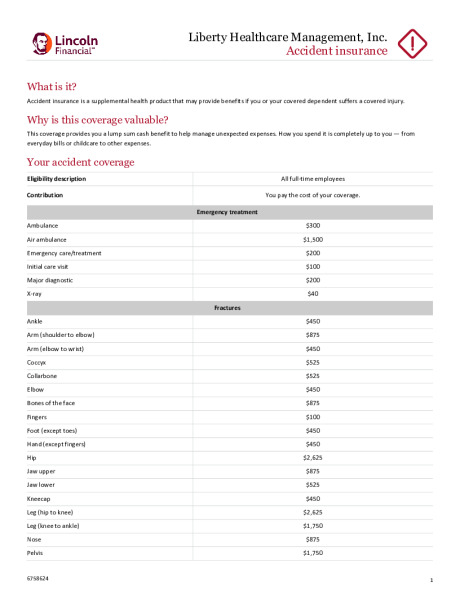

Accident Insurance

- Pays you a benefit for an injury or treatment received due to an accident

- Pays based on a schedule of benefits

- Coverage is available for you, your spouse and eligible dependents

- Policy is fully portable if you leave or retire

- $50 wellness screening benefit. You receive a cash benefit every year you and any of your covered family members complete a single covered assessment test.

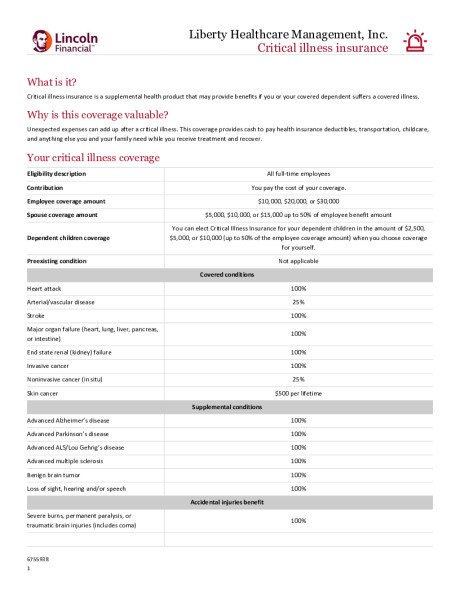

Critical Illness Insurance

- Provides cash benefits if you or a covered family member is diagnosed with a critical illness or event

- Choose from $10,000, $20,000, or $30,000 benefit amounts

- Coverage is available for you, your spouse and/or children

- $50 wellness screening benefit. You receive a cash benefit every year you and any of your covered family members complete a single covered exam, screening or immunization.

Voluntary Pet Insurance

Pet-loving employees can fetch the best health coverage for their pets with My Pet Protection ChoiceSM, available only through workplace benefit programs.

Nationwide offers two ready-made employee plans, plus the ability to customize a coverage plan for individual pets and their specific care needs.

Every My Pet Protection ChoiceSM policy includes guaranteed issuance and these additional benefits to support pet families:

- Emergency boarding and kenneling fees

- Lost pet due to theft or straying

- Lost pet advertising and reward

- Mortality benefit

How to use your pet insurance plan:

- Visit any vet, anywhere.

- Submit claim.

- Get reimbursed for eligible expenses.

Enrollment in pet insurance can occur at any time throughout the year without a qualifying event. Policies renew 12 months after initial effective date. Payment for this benefit is handled via payroll deduction.

Get a fast, no-obligation quote at benefits.petinsurance.com/libertyhcare. To enroll your bird, rabbit, reptile, or other exotic pet, call 877-738-7874.

Allstate Identity Protection

Identity theft can happen to anyone. Get comprehensive identity monitoring and fraud resolution, plus mobile cybersecurity to help you protect yourself and your family against today’s digital threats.

With Allstate Identity Protection Pro+ Cyber, you get features designed to help you defend yourself from today’s risks. Coverage includes the most comprehensive identity protection features in the market, plus browse confidently with powerful cybersecurity features powered by Lookout mobile app.

You can also get coverage for your whole household, plus senior family coverage for your parents, in-laws, and grandparents age 65+, family mobile device protection for up to 10 devices, and up to $2 million in expanded identity theft, cyber and ransomware expense reimbursement.