Disability

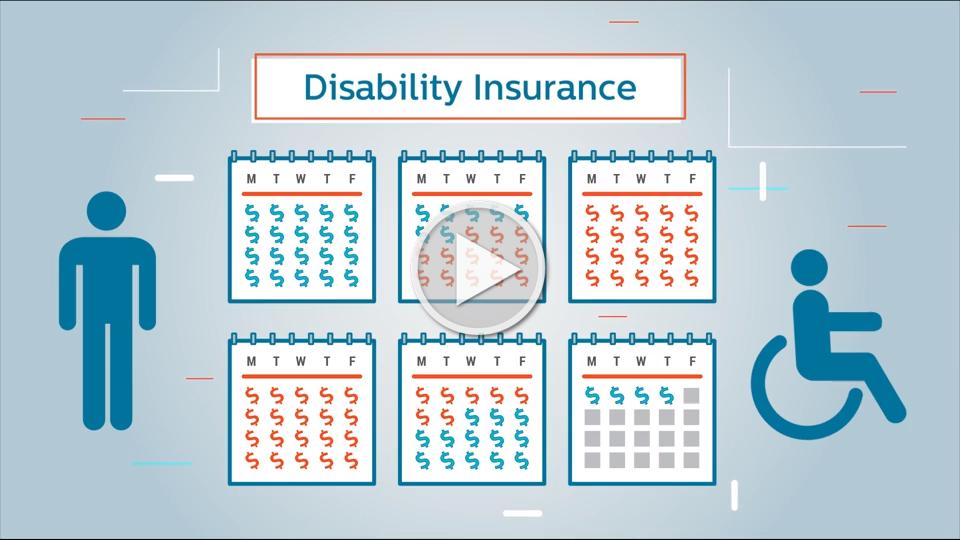

Disability coverage is an important employee benefit that provides income replacement for an employee in the event he/she becomes disabled and cannot work due to a non-occupational injury

or illness.

Liberty Health offers the opportunity to enroll in short term and long term disability.

Premium rates for these benefits are based on age and amount of benefit. Please see the on-line enrollment system for the biweekly premiums. You can elect STD and/or LTD without supplying Evidence of Insurability (EOI).

Supplemental Disability

Short-Term

Liberty Health offers voluntary short term disability through Lincoln Financial. If you become totally or partially disabled due to sickness, accidental bodily injury, or pregnancy, short term disability payments will begin on the day after you have satisfied the elimination of 7 days of continuous disability. Your weekly benefit is calculated as 60% of your base weekly salary to a maximum of $1,000. Once approved, benefit payments will continue for up to 26 weeks of continuous disability.

Short Term Disability: Calculations

Let’s assume an annual base salary of $20,000 for a 29 year old employee

1.$20,000 x 60% of income = $12,000

2.$12,000 / 52 weeks = $230.76

3.$230.76 / 10 (rate calculated based on $10 of coverage) = $23.08

4.$23.08 x $0.853 (age 29 rate of $0.853 per rate chart) = $19.69 monthly

5.$19.69 x 12 (months) / 26 (pay periods) = $9.09 deduction per paycheck

(26 payroll deductions)

Long-Term

Long-term disability is a benefit that provides partial income protection if a serious illness or injury causes you to be on medical leave of absence from work for more than 6 months. During this time, you will receive 40% of your monthly income up to $10,000. This benefit is offered through Lincoln Financial.